Institutional Network

Low-risk, high-return credits for U.S. banks

Grow and diversify your bank’s loan portfolio with BHG Financial’s premium-quality assets.

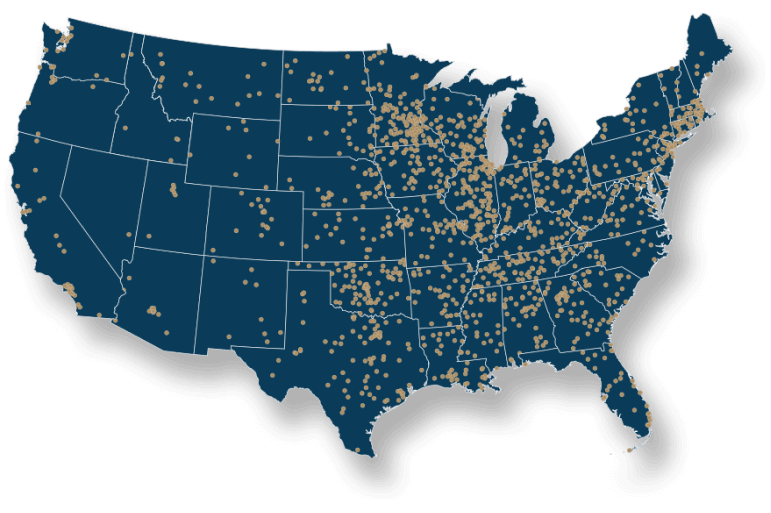

Infographic indicating the locations of BHG Financial Institutional Network partnerships.

$2.2 Billion+

Interest income earned by

our network banks

25 Years

in business serving

community banks

$3.63 Trillion+

Combined assets of banks

on our network

$3.8 Billion+

Notes issued through

11 ABS transaction

Institutional network benefits

See why over 1,725 banks have partnered with us

Institutional Network banks have profited from their access to our simple, fixed-rate, amortizing principal and interest loans with a weighted average FICO over 740, which outperform tier one marketplace super-prime lenders.

-

Strong interest income

-

Superior credit quality

-

No origination costs

-

Credit enhancements

-

Direct ACH payments

-

No membership fees

Premier Credit Quality

Get exclusive access to the nation’s top borrowers

For nearly a quarter-century, BHG Financial has originated or facilitated originations* totaling over $27 billion in loans to borrowers with exceptional credit quality. After rigorous credit analysis, only 14% of our monthly leads are funded. See our borrowers’ weighted average (WA) credit characteristics below.

WA Annual income

$245K

WA Years in industry

19

WA FICO

740

Average loan size

$143K

BHG Financial Loan Hub

The easy, secure way to review and purchase loans

The BHG Loan Hub is our state-of-the-art loan delivery platform. It lets banks explore hundreds of loan files and make informed purchasing decisions to grow and diversify their loan portfolios.

Image is an example only and does not reflect actual customer information.

The President's Chat Replay

BHG Financial’s President of Financial Institutions, Meghan Crawford-Hamlin, will sit down with Jason Laky, EVP of Financial Services at TransUnion, for a candid discussion on credit score modeling considerations, including VantageScore vs. FICO, and what lenders should be thinking about in today’s financial environment

Banks share their BHG Financial experience

No one tells the story about our benefits better than our banks.

Get in touch

Schedule a meeting today

Contact us to speak with your dedicated

relationship partner

Testimonial(s) based on unique customer experience. Individual customer experiences may vary.

* Originations & Facilitated Originations

Facilitated originations are loans funded by partner banks Pinnacle (TN) and County Bank (DE), with borrowers sourced and underwritten by BHG Financial using each originating bank’s credit criteria. If offered for sale by the originating bank, BHG can elect to purchase these loans to either hold on its balance sheet or distribute through various channels.