BHG Financial Loan Hub

Unlimited access to high-earning, low-risk loans

With exclusive access to the BHG Financial Loan Hub, our 1,725+ bank partners have earned over $2.2B in combined interest income since 2001.

$777 Million

Purchased by banks in Q4 2025

Up to 7.25%

Average yield to bank

24/7

Online access

740

Weighted average FICO

Ease and innovation

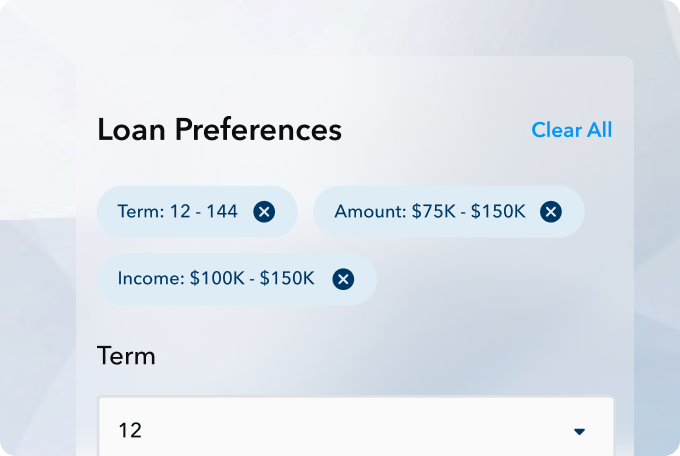

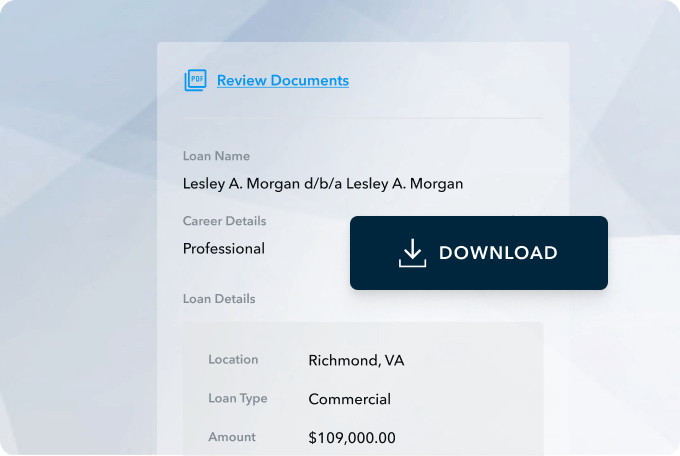

A customizable, bank-friendly hub

Our easy-to-use, secure portal lets banks purchase loans, build their own portfolios, customize their rate, and enjoy other Loan Hub features like the ones highlighted below.

Image is for illustrative purposes only and does not reflect actual customer information.

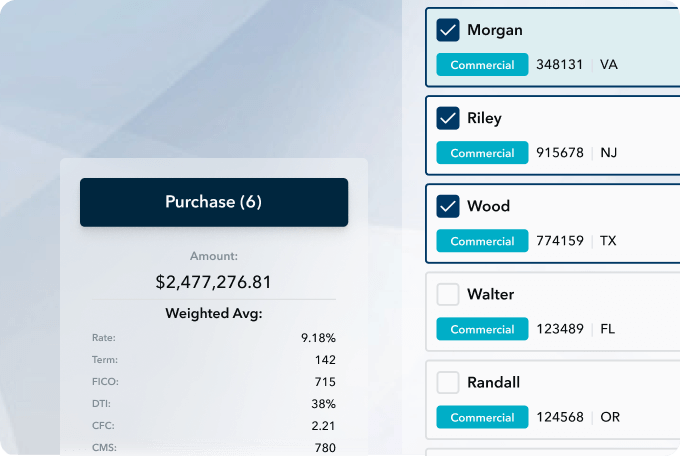

Buy your way

Multiple purchase options

The choice is yours. Select commercial loans, consumer loans, or both. You can also bid on our loans or buy them outright.

-

Loans listed daily for review and purchase

-

Purchase larger-sized commercial loans

-

Loans listed at a set purchase price 24/7

-

Multiple commercial loans packaged in one offer

-

Bid on multiple standard auction loans with one submission

Credit Characteristics

Credit models that identify the propensity to pay

We believe our credit model suite evaluates our loans to a more in-depth degree than any other unsecured debt on the market, having originated or facilitated originations* totaling over $27 billion in loan solutions since 2001. We dive deeper before we lend, uncovering variables that pinpoint the risk associated with every application.

WA Annual income

$292K

WA Years in industry

19

WA FICO

740

Average loan size

$143K

Time-tested profitability

Exclusive program benefits

The Loan Hub is a gateway to top-performing, prime-quality loans with outstanding benefits for banks.

Interest income and net margin expansion

With yields up to 7.25% and higher annualized returns than U.S. Treasuries, BHG loans offer an opportunity for increased cash flow and profitability.

Portfolio diversifiers with no origination fees

Diversify your loan portfolio by rate, credit quality, term, and other metrics. Plus, there are no origination fees on our loans.

3% deposit in your bank, direct ACH payments

Banks receive a deposit equal to 3% of each loan’s total value. Payments are ACH-transferred from the borrower to your bank.

Banks share their BHG Financial experience

No one tells the story about our benefits better than our banks.

Get in touch

Schedule a meeting today

Contact us to speak with your

dedicated relationship partner

Testimonial(s) based on unique customer experience. Individual customer experiences may vary.

* Originations & Facilitated Originations

Facilitated originations are loans funded by partner banks Pinnacle (TN) and County Bank (DE), with borrowers sourced and underwritten by BHG Financial using each originating bank’s credit criteria. If offered for sale by the originating bank, BHG can elect to purchase these loans to either hold on its balance sheet or distribute through various channels.