Personal Loans

Customized financing to consolidate high-interest debt and unlock financial flexibility.

Business loans

Tailored commercial financing that supports all your business needs to help you grow quickly.

Tailored for entrepreneurs that want to establish additional active and passive income streams.

Customized financing to consolidate high-interest debt or fund major purchases or expenses.

About BHG

Programs

Sign in

How to Pay Off Credit Card Debt

If you’re feeling weighed down by credit card debt, you’re not alone. High interest rates can feel like an uphill battle, making it easy to fall behind and tough to catch up.

Understanding how to pay off credit card debt is the first step toward taking control of your debt and reclaiming your financial well-being. Here are a few practical strategies to eliminate credit card debt.

Key Considerations

- If you have a significant amount of high-interest debt and a good credit score, a debt consolidation loan can be a viable option for paying off credit card debt.

- If not consolidating to lower your monthly payments, set a goal and a budget for repayment; targeting one debt at a time using the snowball or avalanche method can help reduce your balances methodically.

- Gradually exceed monthly minimum payments whenever possible to decrease your total interest over time. Even small extra payments can make a big difference in your credit card debt over the long term.

Why is credit card debt hard to pay off?

U.S. credit card balances have surpassed $1.21 trillion, according to the Federal Reserve, driven partially by high APRs.

Credit card debt is difficult to overcome. Even if you don’t make additional purchases, the interest compounds. Only paying the minimum each month means you will carry the debt from month to month, increasing your debt as you accumulate interest charges.

For example, if you’ve amassed $50,000 in credit card debt on a card with a 23% APR, you could pay up to $11,500 per year in interest. Without a plan in place to address the debt proactively, it can become a significant burden.

To start, pay as much as you can toward the debt. Some common ways to do this effectively and consistently include using the debt snowball or debt avalanche method.

What is the debt snowball method?

If you have balances on multiple cards, one of the best strategies to eliminate credit card debt is the snowball method. With the debt snowball method, you pay off the card with the smallest balance first before moving on to the next largest one.

This method is a good choice if you can’t afford to make large monthly payments but want to proactively chip away at your debt. Once you pay off a card, you'll redirect the funds you were using for that payment to your next card balance. You'll continue to do this until you’ve tackled each debt.

Here’s how it looks in action, using the following credit card balances as an example:

- Credit card 1: A $5,500 balance and an APR of 16%

- Credit card 2: A $2,000 balance and an APR of 20%

- Credit card 3: A $10,000 balance and an APR of 23%

Using the snowball method, you’d focus on the second card on this list first because it has the lowest balance ($2,000). Once cleared, you’d move on to the next highest card balance ($5,500) before addressing the third card with a $10,000 balance.

Remember to make minimum payments on all other cards in the meantime; missing any minimum payment can hurt your credit score.

What is the debt avalanche method?

Attacking debt using the debt avalanche method involves paying off the account with the highest interest rate first, regardless of the balance. It can take a while to make progress on —especially if the balance on that card is excessive—but you’ll save money on interest in the long run.

The avalanche method may be a better strategy for you if you can confidently afford a bigger payment and want to pay less in interest while you work to become debt-free.

Here’s how debt avalanche looks in action, using the same credit card balances from above as an example:

- Credit card 1: A $5,500 balance and an APR of 16%

- Credit card 2: A $2,000 balance and an APR of 20%

- Credit card 3: A $10,000 balance and an APR of 23%

Using the avalanche method, you’d tackle the third card first because it has the highest APR (23%). You’d focus on the second card next—APR of 20%—even though it has a lower balance, before moving on to the first card with the lowest APR.

Again, it’s important to focus on making every payment on time to protect your credit score and avoid tacking on additional late fees. It can take a while to knock out the first debt, so patience and consistency is key.

See your offer † real fast

Just a few easy steps to get prequalified!

† This is not a guaranteed offer of credit and is subject to credit approval.

How can debt consolidation with BHG Financial help?

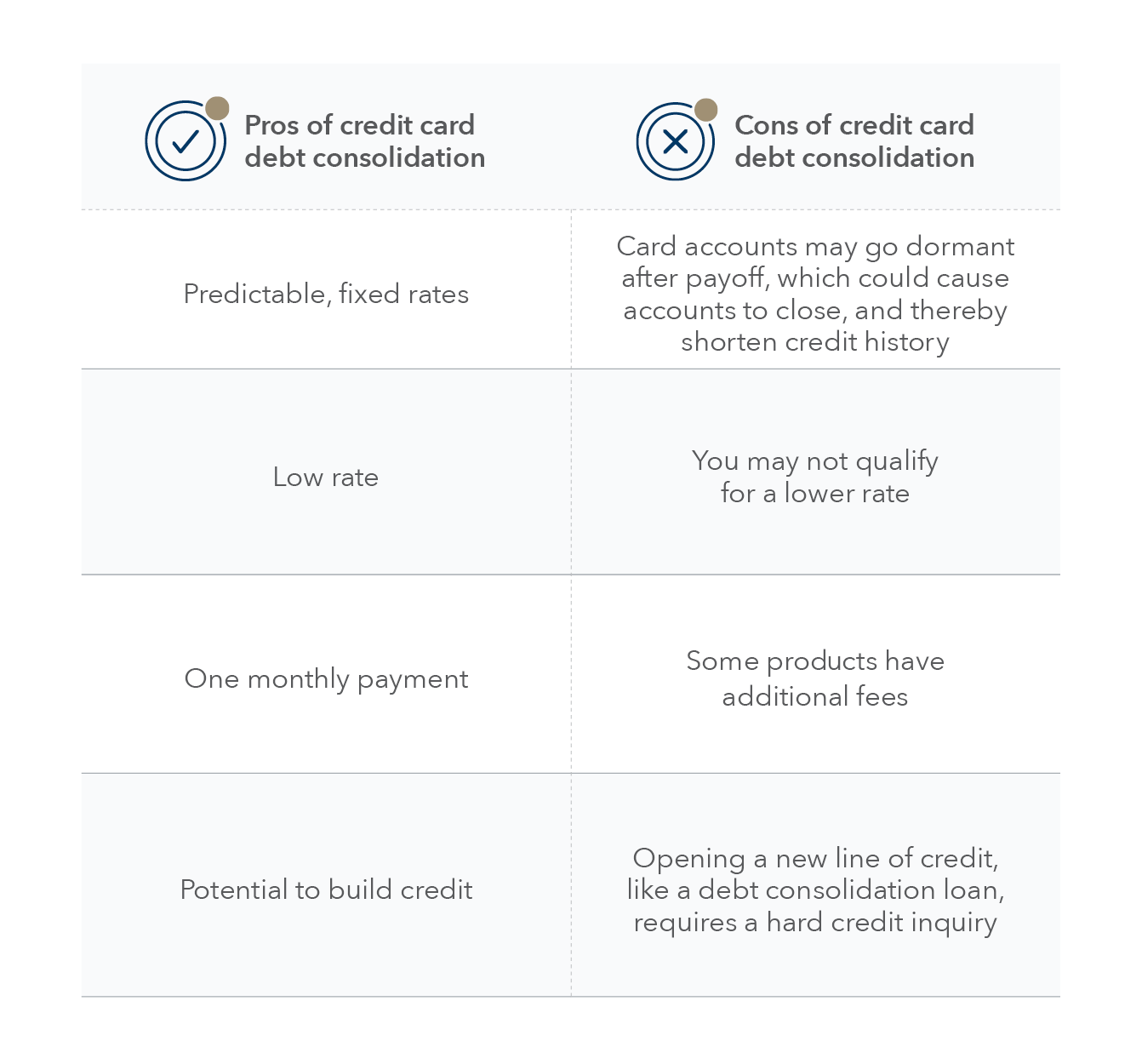

Debt consolidation involves combining multiple credit card debts into one new account or loan and using it to pay off your existing debts. In many cases, consolidation can save you money because the new product may come with a lower interest rate than the ones attached to your cards. Consolidating debt also simplifies the repayment process because you only need to manage one monthly payment.

Some of the most effective credit card consolidation strategies include using a debt consolidation loan or a balance transfer credit card. The best way to pay off credit card debt will depend on the amount of debt you have, your credit history, and your income level.

If you have a significant amount of high-interest debt and a respectable credit score, a lower-rate personal loan for debt consolidation can be a viable option. Debt consolidation loans, like the ones offered by BHG Financial, have flexible repayment terms1 that help keep your monthly payments low.

Do balance transfers help pay off debt faster?

Transferring your balance from one credit card to another can help you pay your debt faster, as long as the new card comes with a lower rate. If you transfer your balances to a new card with a lower APR, you can allocate a greater portion of your future payments to paying down the principal instead of the interest.

That said, there are a few things to know about the timing of balance transfer credit cards:

- You can apply for a balance transfer card in a matter of minutes, but the actual transfer can take anywhere from a few days to several weeks, depending on the credit card company. During that time, you’ll still have to make any payments you owe to your original card company.

- Make sure you understand how long the introductory rate lasts, whether there’s a transfer fee, and what the regular rate will be after the promotional period. Introductory rates typically run for a period of six to 18 months, and if you can’t pay off your balance in full, the new rate may be higher than the rate on your old card.

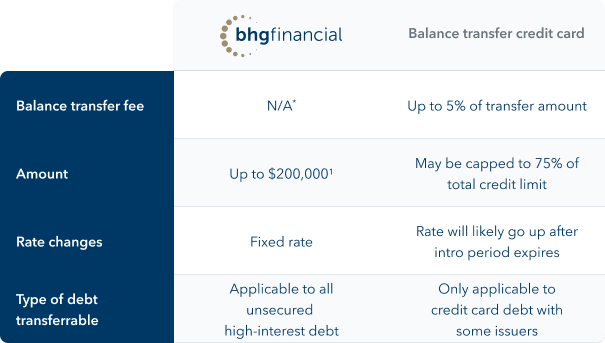

If you worry it may take longer than the intro period to pay off your debt, consider transferring your balance to a debt consolidation loan. BHG offers fixed, affordable payments with terms up to 10 years.1,2 Plus, dedicated loan specialists provide a concierge loan experience, guiding you through the loan process.

|

|

|

Balance transfer credit card |

|---|---|---|

|

Balance transfer fee |

N/A |

Up to 5% of transfer amount |

|

Amount |

Up to $250,0001 |

May be capped to 75% of total credit limit |

|

Rate changes |

Fixed rate |

Rate will likely go up after intro period expires |

|

Type of debt transferrable |

Applicable to all unsecured high-interest debt |

Only applicable to credit card debt with some issuers |

SOURCE: Bankrate, Investopedia, Accessed on 03/14/25

How to pay off credit card debt FAQ

See your offer † real fast

Just a few easy steps to get prequalified!

† This is not a guaranteed offer of credit and is subject to credit approval.

How BHG can help you pay off debt faster

At BHG Financial, we believe financing should fit seamlessly into your life and goals. That’s why we offer personal loans tailored to your needs, with amounts up to $250,0001 and flexible terms of up to 10 years.1,2 Consolidate your high-interest debt with a BHG loan designed to help you move forward confidently.

Plus, you’ll enjoy dedicated, U.S.-based concierge service that works around your schedule—because your time is valuable. Ready to see what’s possible? Use our quick and easy payment estimator to get your personalized loan estimate in just seconds.

Not all solutions, loan amounts, rates or terms are available in all states.

1 Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile.

2 Personal Loan Repayment Example: A $60,000 personal loan with a 7-year term and an APR of 17.06% would require 84 monthly payments of $1,191.38.

Consumer loans funded by Pinnacle Bank, a Tennessee bank, or County Bank. Equal Housing Lenders.

No application fees, commitment, or impact on personal credit to estimate your payment.

For California Residents: BHG Financial loans made or arranged pursuant to California Financing Law license - Number 603G493.

Consolidating personal credit card debt FAQs

Consolidating personal credit card debt can simplify your finances by combining multiple debts into a single monthly payment with more manageable interest rates. In the long run, this can save you from spending more money than you anticipated or previously agreed to on in-terest payments in the future.

Personal debt consolidation can impact your credit score differently depending on the method chosen. For example, applying for a new loan or credit card for consolidation may result in a temporary dip in your credit score due to inquiries, changes in credit utilization, and your his-tory using credit-based financial products. However, making timely payments on the consoli-dated debt can positively affect your credit score by demonstrating responsible financial man-agement.**

Yes, personal debt consolidation can be applied to various types of debt, including personal loans, medical bills, and student loans, in addition to credit card debt. Consolidating multiple debts into a single payment can streamline your repayment process and make it easier to man-age your finances overall.

With highly specialized financing options for accomplished professionals, BHG Financial offers personal loans up to $200K1 to use as you need them. With repayment terms that last up to 10 years,1,2 you can fully bring your financial plan to action by consolidating your personal debts into a simple and affordable monthly payment to help you achieve financial peace of mind sooner rather than later.

Our payment estimator can help you see your personalized estimate quickly, and our dedicated concierge service team can serve your needs every step of the way.

Source: Bankrate, Investopedia - Accessed on 3/14/25

1 Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile.